Más Información

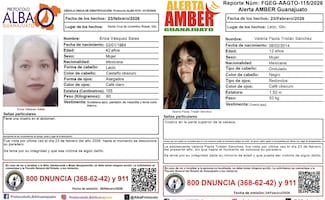

Hallan cuerpos de dos mujeres en caminos de terracería en Silao e Irapuato; difunden fichas de búsqueda de otras 12 jóvenes

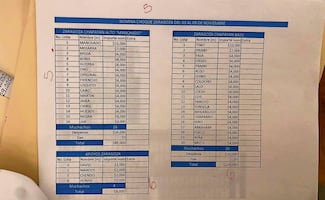

Harfuch: se investiga narconómina de "El Mencho" dada a conocer por EL UNIVERSAL; no hay funcionarios ligados a indagatorias, indica

PVEM se deslinda de Pedro Segura Valladares tras amenazas a Loret; "no es ni ha sido militante del Partido Verde", asegura

Buscan a menor de edad y a su madre, originarios de Reyes Llano Grande, Oaxaca; desaparecieron desde el pasado 24 de febrero

Bankers were hoping on Wednesday that Mexican broadcaster Grupo Televisa may inject some much needed energy into Latin America's moribund primary markets before year-end.

The borrower announced on Tuesday that it intended to issue a bond for up to US$1.2bn over the next 90 days, market conditions permitting.

This follows the completion of global fixed-income investor meetings on Monday through Goldman Sachs, HSBC and Morgan Stanley.

"This is the type of name that could work unlike some of the off-the-run borrowers that have come in the last few weeks," said a DCM banker away from the trade.

Televisa has been absent from the dollar market since May 2014 when it sold a US$1bn 5% 2045 that came at 96.534 to yield 5.227% or 180bp over US Treasuries.

Like most LatAm corporates, however, Televisa management will have to get its mind around the wider clearing levels for bond funding at a time when investors are readjusting their views on emerging market risks.

Its 2045s were trading at a mid market price of around 89.20 on Wednesday, marking a good eight point drop since mid August.

While much of that fall reflects a corresponding decline in the price of the benchmark US Treasury, the spread on the 2045s has also widened about 30bp over that period to 266bp.

The company said it was looking to sell a long-term bond, but it remains unclear whether that means 20, 30 or even 40-year money. "They could do an ultra long 40-year if the market rallied after the Fed (meeting) in December," he said.

A tap of the 2045s is out of the question, only because the bonds dollar price is trading below OID thresholds.

Declining advertising revenues in Mexico, however, have taken their toll on local media companies, as the market opens up to competition.

TV Azteca the second largest broadcaster in Mexico has been particularly hard hit by the changing business climate and the impact of a weaker peso on its credit metrics.

Fitch downgraded the credit to B+ from BB- earlier this month, and its unsecured 2020s are now yielding 13.20%, up from 6.9% in early August.

Televisa, which is rated Baa1/BBB+/BBB+, has been better able to diversify away from traditional advertising and into pay-TV and the telecom business, partly through acquisitions.

Proceeds are expected to be used for capex related to cable and telecom projects, said Fitch, which noted that an aggressive Ps27-28bn (US$1.6bn-US$1.67bn) capex plan will translate into negative free cash flows over the short to medium term.

Noticias según tus intereses

[Publicidad]

[Publicidad]