Más Información

Confirman que cuerpo localizado junto a la UAEM es de Kimberly Joselin; Fiscalía asegura que no habrá impunidad

"El Mencho" tenía presentes a Los Alegres del Barranco; en cartas le hablaban del grupo musical que cantaba su corrido

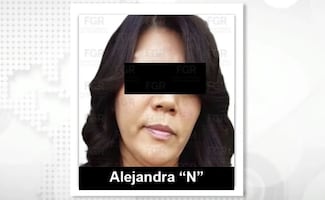

Dan 108 años de prisión a Alejandra “Candela” por delitos de secuestro; está ligada al grupo criminal “Los Rojos”

SCJN niega amparo a Walmart para tener 0% de IVA en todos los productos menstruales; argumenta “ventaja indebida en el mercado”

Emerging equities touched a one-week high on Thursday with the Mexican peso hitting a six-week peak after the final U.S. presidential debate before the Nov. 8 election gave no clear boost to Republican candidate Donald Trump.

Democratic candidate Hillary Clinton was again judged the winner of the debate according to a snap CNN poll, although Trump, who has seen his ratings come under pressure recently, said he may not accept the outcome of the election if he loses.

The peso, the chief proxy for market pricing of Trump's chances, firmed to 18.455 per dollar in Asian trading after the debate's conclusion, its highest level since Sept. 8. It later gave up some of those gains, retreating 0.3 percent, after European traders arrived at their desks.

"It has been driven to a degree by opinion polls in the U.S. and it strengthens when there's a higher likelihood of Hillary Clinton winning," said William Jackson, senior EM economist at Capital Economics.

Trump's threats to tear up a U.S. free trade deal with Mexico and block remittances sent home by Mexicans living in the United States to fund a border wall pushed the peso to record lows last month.

It has rallied over 7 percent since, but Jackson said that with the election out of the way, fundamental factors such as the current account position and weak oil prices could reassert themselves.

The benchmark emerging stocks index traded flat after touching one-week highs earlier in the session, helped by a decent performance in big Asian constituents such as Taiwan , which rose 0.36 percent to a 15-month high.

Noticias según tus intereses

[Publicidad]

[Publicidad]