Más Información

Turnan a ministro Giovanni Figueroa el caso de Mario Aburto, asesino confeso de Colosio; resolverá si condena de 45 años es correcta

FGR, sin investigación abierta contra Karime Macías, exesposa de Javier Duarte; permanece asilada en Reino Unido

SRE pide información de familias mexicanas detenidas por el ICE en centro de Texas; prioriza casos de menores

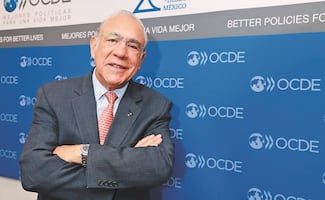

José Ángel Gurría Treviño, el exfuncionario con pensión dorada; su paso por Nafin, Hacienda y la OCDE

Mundial 2026: ¿Habrá alerta sanitaria por sarampión en México durante la Copa del Mundo?; esto dice Sheinbaum

Latin America's largest Coke bottler, Coca-Cola Femsa, reported lower third-quarter profit on Wednesday, hurt by currency volatility and weak sales.

Coke Femsa, which has been on a buying spree in recent years in an attempt to offset slowing Coke sales, is focusing on improving its operations and managing costs in its existing businesses, Chief Financial Officer Héctor Treviño said on a call with analysts.

While Coke Femsa may still consider possible acquisitions in Latin America and elsewhere, the company is focused on increasing sales of existing products, particularly still beverages and juices "where we see lots of opportunities for growth," he said.

The bottling company said profit fell to 2 billion pesos (US$118 million), from 3.5 billion pesos in the year-earlier quarter, and total revenue dropped 10 percent to 37.7 billion pesos.

Still, the company's success in hedging raw materials' costs helped it increase its profit margin and investors appeared to react positively to that news, sending the share price up 1.9 percent to 126.63 pesos after the results statement.

Coke Femsa has also been trying to raise prices where it can, at least in line with inflation, said Trevino. "We are trying to protect those margins," he said.

Sales of million-unit cases increased by only 1.1 percent, hurt by a dip in sales volume in Brazil, which is heading toward a prolonged recession.

Coke Femsa has been trying to increase sales of bottled water and other non-carbonated beverages, to offset a dip in Coke sales in its main market since Mexico's government introduced a fizzy-drinks tax.

Coke Femsa's parent company, Femsa, is due to report full results after the market close.

Femsa operates the Oxxo convenience store chain and holds a 20 percent stake in Dutch brewer Heineken.

Noticias según tus intereses

[Publicidad]

[Publicidad]