Más Información

Buscadora asesinada presenta lesiones por arma punzocortante: Fiscalía; recientemente participó en rastreo de un desaparecido

VIDEO: Avión militar con miles de pesos en efectivo se accidenta en Bolivia; policía dispersa con gas lacrimógeno rapiña

Artículo 19 exige investigación y protección al comunicador Víctor Badillo; fue atacado en instalaciones de su medio en Nuevo León

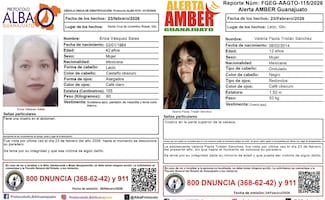

Hallan cuerpos de dos mujeres en caminos de terracería en Silao e Irapuato; difunden fichas de búsqueda de otras 12 jóvenes

Harfuch: se investiga narconómina de "El Mencho" dada a conocer por EL UNIVERSAL; no hay funcionarios ligados a indagatorias, indica

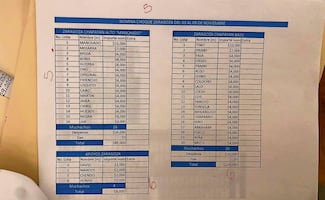

Mexican authorities

have identified 10,000 tax fraudsters ; 700 of them were blacklisted by the Tax Administration Service (SAT) this year. They are accused of issuing fake invoices and tax receipts.

After the SAT analyzed the first tax returns or the VAT payments made in February, authorities could issue the first arrest warrants after a new tax law was implemented in 2020; however, taxpayers can reach an agreement to avoid going to jail.

According to information provided by the SAT, at least 100 taxpayers have been granted amparos yet the majority of those who issued false invoices haven’t been able to prove their innocence and only 10 of them provided enough evidence to dismiss the charges against them.

The federal government has blacklisted construction companies, architecture firms, consulting firms, tax and administration counseling firms, the State of Mexico Pymes Council, and other individuals. They are all accused of issuing false tax receipts and invoices .

On June 23, Raquel Buenrostro, the head of the SAT, filed 7 lawsuits against 43 companies t hat allegedly issued false invoices and tax receipts for operations that amounted to MXN 93,000 million.

Recommended: Mexico takes legal action against large company accused of tax fraud

Buenrostro announced the SAT would file the lawsuits before the Attorney General’s Office against the groups that that incurred in this crime to avoid paying taxes.

Raquel Buenrostro added that these companies are linked, share legal representatives , and shareholders . She also explained that 8,000 taxpayers hired these companies.

During a news conference, tax prosecutor Carlos Romero Aranda said they will be charged with tax fraud and money laundering .

In Mexico, tax fraud is punished with top to nine years in prison and organized crime with up to 16 years.

According to investigations, these companies simulated financial operations for MXN 93,000 million. This generated an MXN 24,000 million loss for tax authorities in income tax and MXN 11,000 million in VAT.

Recommended: Mexico improves its tax collection scheme

gm

Noticias según tus intereses

[Publicidad]

[Publicidad]